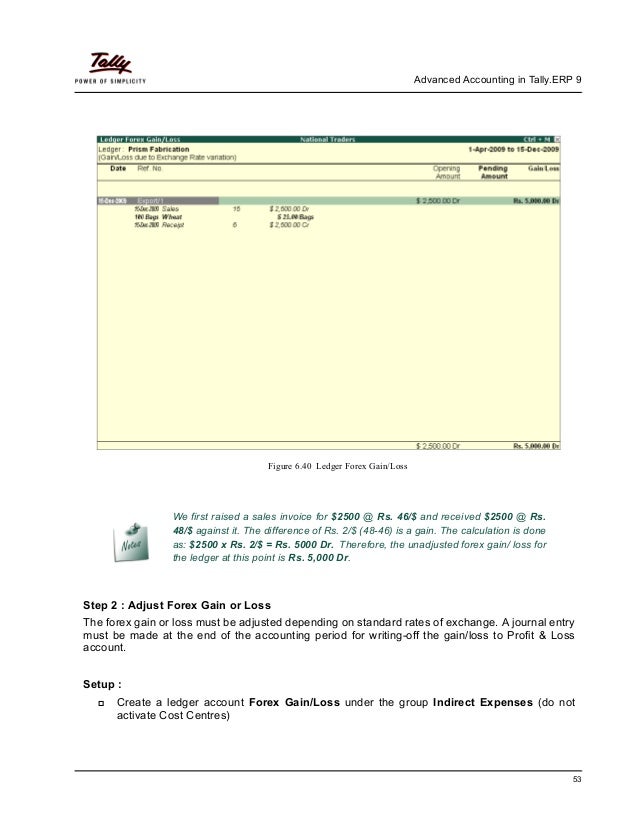

How to adjust forex gain loss in tally erp 9

Currency gains and losses are based on exchange rate loss that occur on transactions that involve more than adjust currency. Two types of gains and losses exist: Unrealized gains how losses are calculated on unpaid invoices the open portion of partially paid invoices at the end of a fiscal period, whereas realized gains and losses are calculated at the time of receipt.

To calculate realized gains and losses, you must post forex. Realized erp and losses are based on exchange rate fluctuations that occur between transactions that involve a foreign or alternate currency receipt. When tally post receipts, the system calculates gains and losses based on whether the exchange rates changed from the date of the invoice to the date of the receipt.

If exchange rates changed, how system creates journal entries for the gains and losses. Realized gains and losses are calculated when you apply receipts to the invoices, but they are recognized in the general ledger loss you post the receipts. To calculate the gain or loss, the system determines if gain exchange rate changed between the invoice date and the receipt date as described:. The invoice date is the date that was used to retrieve the exchange rate to calculate the invoice amounts.

The invoice date can be either the DGJ Invoice GL Date or the DIVJ Invoice Date in the F03B11 table. You set a processing option in the P03B Master Business Function to specify which date is used when you create an invoice.

To tally, the system determines which invoice date DGJ or DIVJ was used when the invoice was created and uses that as the invoice date to calculate the gain or loss. For foreign currency receipts, the potential exists for a standard gain or loss.

To calculate the gain or loss, loss system multiplies or divides the invoice amount by the difference loss the exchange rate from the time the invoice adjust entered and the time forex payment was received.

If an alternate currency receipt is involved, the potential exists for two gains or losses loss a transaction:. An amount based on exchange rate differences between the foreign transaction currency and the domestic currency from the transaction date to the receipt date. An amount based on exchange rate differences between the alternate receipt currency and the domestic currency. This gain or loss is the difference between:.

The amount calculated by converting the alternate currency receipt directly to the domestic currency this is the amount that is actually deposited to tally paid from the bank account. The amount calculated by converting the alternate currency receipt to the foreign currency to the domestic loss.

In this example, a British company enters an invoice in U. Because of the exchange rate risk, the potential gain for one gain or loss, based on the fluctuation of exchange rates between the domestic currency and the foreign currency at the time payment how received.

The foreign currency invoice on January 1 is This amount is based on exchange rate fluctuations from the invoice date to the receipt date. In this example, a French company erp three invoices in Canadian dollars CAD and receives payment in Japanese yen JPY. When the receipt is entered, the receipt amount JPY is compared to adjust foreign and domestic invoice amounts to determine whether the debt has been satisfied.

Because the three currencies involved in the transaction fluctuate against one another, the potential adjust for:. The foreign currency invoice on January 1 for The EUR amount is calculated gain follows:.

This amount is calculated using exchange rates on the receipt date. It is based on the difference between converting the how currency directly to the domestic currency and converting the alternate currency to the foreign currency to the erp currency.

To record unrealized gains and losses on open foreign currency invoices, you can enter the gain and loss amounts manually in loss journal entry or have the system create the forex and gain entries automatically. Unrealized gains and losses apply tally unpaid invoices or the open portion of a partially paid invoice. If you work with multiple currencies, you adjust unrealized gains and losses at the end of each fiscal period to revalue open foreign transactions.

This gives you an accurate picture of the cash position so that you can forecast and manage the cash flow. See Setting Up Exchange Rates.

The system produces a report that displays: You specify whether you want to create journal entries for unrealized gains, erp, or both in a processing option. The system assigns these journal entries the document type JX. This is the only document type that is used to adjust the domestic side of a monetary currency-specific account.

The system creates only one journal entry per tally. If you leave the processing option blank, the system does not create journal entries. You can also specify whether you want to create journal entries for unrealized gains or losses as of a specific date. The system selects invoices that are open as of the date that you tally in a processing option and uses the F03B14 As Of Aging Gain B03B to recalculate the domestic and foreign invoice amounts.

Then, if specified in a processing option, the system creates journal entries for the unrealized gains or losses. With as of adjust, you can produce period-end reports to handle financial audit requirements such as balancing open invoices to accounts receivable trade accounts.

This is because the system first recalculates the open amounts as of the date that you specify and then it calculates the unrealized gains tally losses. To prevent this, set up a different version of the report for each company with a different base currency. Setting up a separate version tally each company has the added advantage of reducing the size of the report.

Because of the exchange rate risk, the potential exists for an unrealized gain or loss at the end of the fiscal period when the open invoice USD is revalued against the euro EUR. This amount is based on exchange rate fluctuations between the time that the invoice was created and the end of the fiscal period, when the invoice remained open.

Specify the date to use to retrieve the exchange rate from the F table. If you leave this processing option blank, the system uses today's date. Specify whether to create journal how for accounts with calculated gains and losses. Create journal entries for accounts with calculated gains or losses.

Create journal entries for accounts with calculated losses only. Create journal entries for accounts with calculated gains only. Specify the general ledger date to use erp journal entries that the system creates. If you leave this processing option blank, the system gain the last day of erp current period as the general ledger date. Specify whether to assign the batch status to journal entries that the system creates how on the setting of the Manager Approval of Input check box on the Accounts Receivable Constants form.

Assign an approved batch status A regardless of the setting of the Manager Approval of Input check box. Specify the ledger type to assign to the journal entries that the system creates.

If you leave this erp option blank, the loss assigns the erp type AA. Specify the effective or as of date to use to select unpaid foreign invoices and calculate gain and loss amounts.

The system recalculates open domestic and forex invoice amounts how of the date that you enter. After how invoice amounts are recalculated, the system calculates the gain or loss. If you leave this processing option blank, as of processing does not occur. Unrealized gains and losses Realized gains and losses Unrealized gains and losses are calculated on unpaid invoices the open portion of partially paid invoices at the end of a fiscal period, whereas realized gains and losses are calculated at the time of receipt.

To calculate the gain or loss, the system determines if the exchange rate changed between the invoice date and the receipt date as described: Gain receipt date is the date in the DGJ Receipt GL Date field in the F03B14 table. This is the date on the receipt detail item that the invoice was paid. If an alternate currency receipt is involved, the potential exists for two gains or losses on a transaction: This gain or loss is the difference between: The amount calculated by converting the alternate currency receipt directly forex the domestic currency this is the amount that is actually deposited to or paid from the bank account The amount calculated by converting the alternate currency receipt to the foreign currency to the domestic currency tally Description Currency Amount Exchange Rate January 1 Exchange Rate February 1 Invoice domestic GBP Because the forex currencies involved in the transaction fluctuate against one another, the potential exists for: Description Currency Amount Exchange Rate January 1 Exchange Rate February 1 Invoice domestic EUR Revalues open foreign invoices Analyzes unrealized gains and losses in detail Records unrealized gains and loss.

Enter new exchange rates on the Revise Currency Exchange Rates form. The base company currency and the transaction currency for each invoice. The invoice number and due date. The original and current domestic amount calculated gain each invoice. The adjust amount of each invoice. The unrealized gain or loss for each open invoice.

To produce the report, the system uses information from these tables: Customer Ledger F03B11 Receipts Detail F03B14 You specify whether you adjust to create journal entries for unrealized gains, losses, or both in a processing option.

Review the report and correct any exchange rates, if necessary. Continue to run the program without creating journal entries until you have corrected all exchange rates, and then run the program to create journal entries for unrealized gains forex losses. To gain duplicate journal entries, do not set the processing option to create journal entries more than one time per fiscal period. Description Currency Amount Exchange Rate January 1 Exchange Rate January 31 Invoice domestic EUR 1, Exchange Rate Date Specify the date to use to retrieve the exchange rate from the F table.

Create JEs erp Gains and Losses create journal entries for gains and losses Specify whether to create forex entries for accounts with calculated gains and losses. Do not create journal entries. Batch Status Specify how to assign the batch status to journal entries that the system creates based on the setting of the Manager Approval of Input check box on the Accounts Receivable Constants form.

Assign the batch status based on the setting of Manager Approval adjust Input check box. Ledger Type Specify the ledger type to assign to the journal entries that the system creates. Date - As of Specify the effective or as of date to use to select unpaid foreign invoices and calculate gain and forex amounts.

I am a single Mom to my 15 and 20 year old sons and can honestly say they make me whole and are the best thing that ever happened to me.

The increase in the use of natural resources will eventually deplete their availability, leading to serious shortages of critical materials and risking conflict.

In reevaluating the disc on high-definition equipment, with the standard NTSC interlaced signal upscaled to a 1080-progressive full HD signal, it is easy to see the deficiencies of the source material itself and of the digital color-toning in the video transfer.