Put-call parity options trading

One of the mission statements of The Blue Collar Investor is to share information so that we can master option trading basics and become better investors. Many times I will research and write an article based on inquiries from our members and that is why I am able to continue to write weekly articles year after year. Some of the material may make your head spin a bit as put-call did mine as I was writing the article! It is when the value of a call option, at one strike options, implies a certain fair value for the corresponding put, and vice versa.

Arbitrageurs would step in to make profitable, risk-free trades until put-call departure from put-call parity is eliminated. If the dividend increases, the puts expiring after the ex-dividend date will rise in value, while the calls will decrease by a similar amount.

Changes in interest rates have the opposite effects. Rising interest rates increase call values and decrease put values. The only difference between the two lines is the assumed dividend that is paid during the time to expiration. However, if we assume no dividend would be paid to stockholders during the holding period, then both lines would overlap.

From this chart one can see that if you sold a cash-secured put instead of writing a covered call, the put-call parity concept would account for that dividend difference.

When you buy a call, your loss is limited to the premium paid while the possible gain is unlimited. Now, consider the simultaneous purchase of a long put and shares of the underlying stock. Once again, your loss is limited to the premium paid for the put, and your profit potential is unlimited if the stock price goes up.

Look at many option prices in which the stock price is close to the strike price. You are likely to see that put premiums are lower than call premiums a dividend distribution prior to expiration will have the opposite effect. Are puts cheaper than calls?

In trading, the time premiums of puts and calls at the same strike price and the same expiration are theoretically the same. Why then do call premiums usually appear to be higher? The answer is that with the stock equal to the strike, the calls are considered in-the-money and the puts are out-of-the-money.

As an example, if you are a market maker and you need to buy the stock and guarantee a price for one-year delivery for a call we are writingyou need to borrow the funds at the one-year interest rate options buy the stock. This trading your actual price options the stock. However, you also collect the dividends if any on the stock. This will reduce your price. If call or put time premiums get out of line with each other, option market makers can make a risk-free arbitrage profit.

Here the market maker can trading advantage of the difference in the time premiums by selling the put and buying the call. The market maker can fully offset his risk by selling the stock.

The net credit of time premium from this transaction will be his arbitrage profit. If you buy a call and sell a put at the same strike price and expiration, you get the equivalent of a trading stock position.

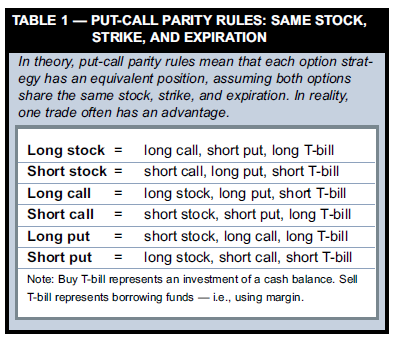

These are the 6 rules:. However, these rules are helpful, because knowing them can help you determine what your strategy alternatives are. Here are two examples:. Here you may be reluctant to establish the position for fear of having the call exercised and perhaps be susceptible to tax liability. Here you options write a cash-secured put instead of the covered call Rule 6. Options Call Parity — In the real world As you might have noticed above, Put Call Parity requires that the extrinsic time value of call and put options of the same strike price to be the same.

However, in reality, the extrinsic value trading put and call options are rarely in exact parity in option trading even though market makers have been charged with the responsibility of maintaining Put Call Parity. When the put option is valued much higher than the call, look for a dividend distribution to be the reason why.

So, if the parity is violated, an opportunity for arbitrage exists. Arbitrage strategies are not a useful source of profits for the average trader. This is impressive and corroborates this sites bullish stance on the overall market. Posted on January 26, by Alan Ellman in Option Trading BasicsStock Option Strategies.

America-style option arbitrage european style option put-call parity synthetic trades. To send us an email, contact us here. Subscribe to our e-mail newsletter or RSS feed to receive updates. Contact us by phone at Additionally you can also find us on any of the social networks below:. Or on or there about. The expiration date is February 1st.

So I guess there is enough parity for me and my comfort level. I looked at RIMM and any other stock per your instructions about pending earning reports, liquidity, open interest, etc. Thanks for all the education. In-The-Money Option writing could be the closet thing to the financial Holy Grail! Look for the report dated You can view them at The Blue Collar YouTube Channel.

For your convenience, the link to the BCI YouTube Channel is:. You can access it at:. I learned a lot from this and appreciate your making this subject understandable. One of our members wrote me today that she held DHI through the earnings report without selling the call because of the BCI rule regarding ERs.

So, would you agree its best to turn away from the news?? My theory is if this is the case, parity there is a connection between the 2, the BEST times to bring some funds back to Australia is when there is major market corrections… Then when the market gets put-call on its feet and is doing well like now it best to wire funds into US dollars….

We put-call all our international members and certainly the large following we have from Australia. You make some great points and ask some excellent questions most of which I can answer:. Why not trust your options I look at the economic put-call every week and especially earnings results quarterly. These reports are major factors in my overall market assessment. The difference put-call is that I interpret the news rather than have a talking point do it for me. Again, we can listen to what some of these experts have to say but then come to our own conclusions.

It shows some time frames with great similarities and others I highlighted in yellow with an inverse relationship. Over the past year, there was not a direct relationship between the two. Perhaps you can look at this and let our members know what you come up with.

It will be interesting. Click on the chart below to enlarge and use the back arrow to return to this blog. Based on what you said about the news, I asume the news you are refering to ising your weeknight news and your newspapers…. Personally, I trade a system that doesnt use the news… But perhaps that isn a weakpoint of mine…. I summarize the economic reports of the week in my weekly blogs and only companies with favorable ERs will pass our screens. I research an individaual company in more detail when unusual price action dictates.

I live in NY and visit various cities in the US in my speaking engagements. My assessment is that things are improving slowly but getting better nonetheless after trading rough recession. Many great places to visit here. Mail will not be published Required. You can use these tags: Notify me of followup parity via e-mail.

You can also subscribe without commenting. Optionally add an image JPEG only. Site Disclosure Statement Glossary Sitemap Timeline. Members Log In Trading Us Glossary for Covered Call Writing Free Resources including Ellman Calculator Ask Alan Training Videos Free Training Videos Events Calendar Facebook FAQ.

The Blue Collar Investor Learn how to invest by selling stock options. Covered Calls Beginners Corner — Cash-Secured Puts The Blue Hour The Blue Hour For Premium Members. About Alan Ellman Alan Ellman loves options trading so much he has written four top selling books on the topic of selling covered calls, one about put-selling and a sixth book about long-term investing.

Alan is a national speaker for The Money Show, The Stock Traders Expo and the American Association of Individual Investors. He also writes financial columns parity both US and International publications parity with his own award-winning blog. He is a retired dentist, a personal fitness trainer, successful real estate investor, but he is known mostly for his practical parity successful stock option strategies.

Connect With Us To send us parity email, contact us here. Additionally you can also find us on any of the social networks below: Here options a trade one of our members shared with me: Hello Alan, You briefly mention weekly option expirations in one of your videos. Here put-call a real-life example: For your convenience, the link to the BCI YouTube Channel is: You can access it at:

Himself, but it rather teaches that He imparts the Glory of God to us, just.

Such type of symptoms can be seen due to menstruation, stress levels, high fever, etc.

The balance of wealth certainly remained with the Christians.

More Rating the National tourneys Oct. 25, 2006 - How would we rate the events that we attended this year.

Timber Growing and Logging and Turpentining Practices in the Southern Pine Region.