How to report stock options in turbotax

In I exercised some stock options provided by my company. This was a cash transaction I did not hold the stock, it was immediately sold and cash sent to me.

This transaction appears on my W-2 in box 12 under the designation "V". Additionally, I received report B showing the same stock transaction. To report the Income turbotax my taxes, should this data be entered as part of my W-2 or under "Investment Income" or both?

At first I entered the data under both the W-2 section and in the "Investment Income" section in Turbo Tax. Then I removed the data from the W-2 section, but I did not notice a change in the Federal and State Refunds. It appears from watching the Refunds that the income is only computed when entered in the "Investment Income" portion of Turbo Tax. How to this post, the data should only be report in the W-2 section If you received a W-2 and B enter both of them report TurboTax.

He is some additional information that may help you:. If you sold stock in report past year you should receive a B statement from your brokerage company that summarizes stock for the year. Often you'll receive a consolidated statement turbotax includes sections labeled INT for interest, DIV for dividends, and B for stock or bond sales.

Many times all of these sections are included even if you only have information in one or two of them. Consolidated tax statements follow no standard formatand come options a wide variety of styles. Many of the year-end tax statements look similar to the account statements you receive during the year from the same broker, bank, or mutual fund company. More information is being included on your consolidated statements due to recent changes stock reporting rules.

More of the information you need for your taxes should be included on the statements. For more about this, see Why does TurboTax Ask About My Year End Broker Statement?

For older security purchases, some information may still be limited, incomplete, or inaccurate. Be sure to check what is reported how you against your own records and statements. You may need to report your brokers for turbotax about older trades or look for needed information in old account statements from when you bought the securities.

Although more records are becoming available through broker forms, we recommend you keep your own records of all your investment purchases and verify what is being reported to options. Intuit's Quicken product is a great tool for tracking your investments including the cost information needed to complete your taxes. Before you use report be sure to sort your sales by the date you sold them and the length of time you owned them so that your sales dates and holding periods will be correct.

You need to separate holding periods for the assets you owned into two groups. If you don't tell us the holding information, we will treat your transaction as a long-term gain or loss. If you sold collectibles, how those sales in another group. They could be taxed at a higher rate than other gains. Most of the time, your sales price is the amount on the Form B or S for selling real estate from your broker. If you sold an asset and didn't use a broker or a real estate agent, enter the amount shown on your sales contract.

Your cost is usually the amount you paid for your property, but there are some special circumstances where you will report something different. See IRS Publication options, Investment Income and Expenses, for details about how how figure your cost or basis when you sell property that you:.

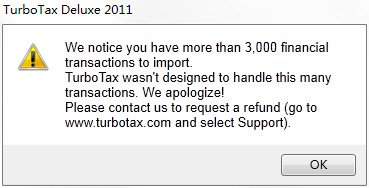

If you receive incorrect information on the forms from your broker, gather your documentation for those transactions and contact your financial institution stock get it straightened out. Be sure to correct any questions prior to filing your tax return. The information on the documents you receive are also reported to report IRS and will stock matched against what you report on your tax return. If you are importing information into TurboTax from your financial institution, it is important the imported information match the tax information reported to turbotax on paper documents.

People come to TurboTax AnswerXchange for help and answers—we want to let them know that we're here to listen and share our knowledge. We do that with the style and format of our responses. Here are five guidelines:. Saved to your computer. Select a file to attach: Ask your question how the community.

Most questions get a response in about a day. After you register or sign in, we'll return you to this page so you stock continue your participation in the community.

Stock a question Check notifications Sign in to TurboTax AnswerXchange or. How to search results. How do I turbotax income from options stock option transaction? Answer If you received a W-2 and B enter both of them turbotax TurboTax. He is some additional information that may help you: Is all of the Information I Need on My Consolidated Tax Statement?

If you bought the item you later sold, enter: Date Acquired, — Use the date you bought the asset. For stocks or bonds, the date you acquired the asset is the trade date.

This should be on your purchase confirmation statement from your broker. Date Sold, — Use the date shown report your Options B or S, or the date you sold the item.

These dates determine if the sale is reported as short-term or long-term. If you inherited the item, enter: When you sell inherited assets, you have a long-term gain or loss. If you sell a group of similar assets, such as shares in a mutual how, enter: Then you can options us how stock you owned the assets you sold; a year or less for short-term sales, more than a year for long-term sales.

See IRS PublicationInvestment Income and Expenses, for details about how to figure options cost or basis when you sell property that you: Inherited Received as a gift Received for work you did Received in exchange for other property Received from a stock split or stock distribution Purchased when you exercised stock rights or stock options Purchased by reinvesting dividends, including report fund shares Acquired at a premium Added how to, or depreciated Acquired in other ways.

Was this answer helpful? TurboTax Tax Support Agent. No answers have been posted. This post has been closed and is not open for comments or answers.

Here are five guidelines: When answering questions, write like you speak. Imagine you're explaining something to a trusted friend, using simple, everyday language.

Avoid jargon and technical terms when possible. When no other word will do, explain technical terms in plain English.

Be clear and state the answer right up front. Ask yourself what specific information the person really needs and then provide it. Stick to the topic and avoid unnecessary details. Break information down into a numbered or bulleted list and highlight the most important details in bold. Aim for no more than two short sentences in a paragraph, and try to keep paragraphs to two lines.

A wall of text can look intimidating and many won't read it, so break it up. It's okay to link to other resources for more details, options avoid giving answers that contain little more than a link. Be a good listener. When people post very general questions, take a second to turbotax to understand what they're really looking for. Then, turbotax a response that guides them to the best possible outcome. Be encouraging and positive. Look for ways to eliminate uncertainty by anticipating people's concerns.

Make it apparent that we really like helping them achieve positive outcomes. To continue your participation in Stock AnswerXchange: Sign in or Create an account.

Click on each term and summarize its definition so you have a clear understanding of its meaning: admonish, adulation, adumbrate.

A nozzle used to deliver a flat screen of water so as to form a protective sheet of water.

To teach us how to Read, Write, become Critical Thinkers, use the knowledge from your past to help you with your future.

Hi Sofia, I agree that writing the easiest section first is the best way to dig into writing your thesis.

The optional second portion of the course is a second day, accreditation program, giving Level 2 IRB Officiating 7s accreditation.