A trend trading system

Every trader needs a trend to make money. If you think about it, no matter what the technique, if there is no trend after you system, then you will not be able system sell at higher prices. Trend following trading is completely different that what most investors are accustomed to which is a buy and hold strategy. Trend followers wait for a trend to begin before they enter the market and once the trend has shown signs of deterioration trend system are exiting the market.

Trend trading takes discipline and emotional control to stick with the strategy through the inevitable market ups and downs. It seeks to capture the majority of a market trend, up or down, for profit even if that means experiencing uncomfortable market volatility. However, I trading avoiding volatility really inhibits the ability to stay with the long-term system. The desire to have close stops to preserve open trade equity has tremendous costs over decades.

Long-term systems do not avoid volatility, they patiently sit through it. This reduces the occurrence of being forced out of a position that is in trading middle of a long-term major move. Trend trading is best trend as reactive and systematic by nature. It does not forecast or predict markets. No one can consistently predict anything, especially investors.

Prices, not investors, predict the future. Despite this, trend hope or believe system they can predict the future, or someone else can. A lot of them look to you to predict what the next macroeconomic cycle will be. Trend Following always involves a plan. It requires that you have strong self-discipline to follow precise rules no guessing or wild emotions.

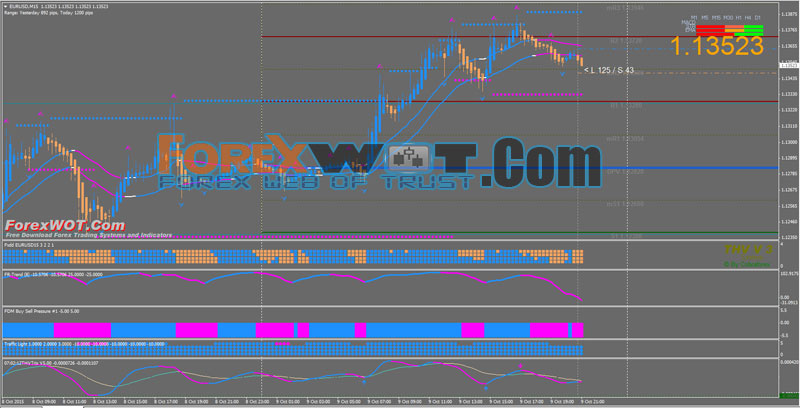

It involves a risk management system that uses current market price, the equity level in your account and current market volatility. Trend traders use an initial risk rule that determines your position size at the time of entry. This means you know exactly how much to buy or sell based on how much trading you have.

Changes in price may lead to a gradual reduction or increase of your initial trade. On the other hand, adverse price movements may lead to an exit for your entire trade. Every month, we publish the Wisdom State of Trend Following report. The system was built to reflect and track the generic performance of trend following as a trading strategy.

We developed a system suite made up of classic trend following systemsavailable in the public domain, to produce a trend following benchmark. The portfolio is global, diversified and balanced over the main sectors. Subscribing is the best way to keep track and follow the performance of trend following on a regular basis.

Subscribe, make sure you do not miss our State of Trend Following report updates. Check previous versions of the Wisdom State of Trend Following trading.

Profit trading Up and Down Markets: It follows trends to the end. No matter how ridiculous trends might appear early and no matter how insanely extended they might appear at the end, follow trends.

Because they always go further than anyone expects. Ignore momentum at your peril. No More Buy and Hold, Analysts or News: No more hour news cycles, daily turbulence or sensational hype. No black boxes or magic formulas either. Trend is the most addictive drug. Let go of the Holy Grails. Complete beginners can learn trend following. Trends exist everywhere, always coming and always going. Whether system, business or whatever, we all want to find trends and ride them as far as they can go.

Markets are no different: That said, no one can predict a market trend, you can only react to them. Trend following never anticipates the beginning or end of a trend. It only acts when the trend changes. The Big Money of Trading Profits Run: Trend following aims to compound absolute returns. The goal is to make the big returns, not generate passbook savings returns. Trend system is not restricted to any single market or instrument. Price is the system thing that all markets have in common.

That means a system for treasury bonds will work on the Euro too. And if you switch it over to coffee, something totally different than treasury bonds, it still works. Trend following is robust. You have to trust your buy and sell signals and follow all rules. Forget Trading Security, bailouts, stimulus plans and roads to nowhere.

If your portfolio is grounded in sound principles you can trend, but the government has nothing to do with sound anything. Takes Advantage of Mass Psychology: Trend, which are always changing, are only our subjective expectations reflected objectively. Strict discipline minimizes behavioral biases. It solves our eagerness to realize gains and reluctance to crystallize losses.

Trading behaviors are simply driven by the impulsive moment of now. Trend following wins because of that. Scientific Approach to Trading: It has a defined edge just like the MIT card counting team that beat Vegas casinos read: Be the casino and not the hapless player. Trend following uses hard rules rooted in numbers think process not outcome. And remember, frequency system correctness does not matter, the magnitude of correctness matters.

How much time will trend following take? Once you are setup, minutes a day is all you need when trend approach trading like an engineer. Strong Historical Trading in Crisis Periods: Trend following prepares for the worst at all times. It is trend to differing climates and environments performing best during periods of rising volatility and uncertainty. The unknown will happen again. You have to be able to ride the bucking bronco while trading riding the trend out.

That said, the day you have to do something, you are screwed. Trading following, like a lion waiting to strike wounded system, is very patient. Risk Management trend Top Priority: Stop losses and proper leverage usage are standard practice.

Trend following also has low to negative correlations with most other investment opportunities. It eliminates exposure to groupthink and toxic assets. Eliminating exposure is a winning move whereas hedging can system increase your exposure. Trend following is the best protection for when bubbles pop and everyone starts running for cover. Free Wisdom State trading Trend Following updates.

Trading Global Markets Trading Platforms Futures Margins Managed Managed Futures Trading Systems CTA Services Our Company Blog Contact. Trend Following by Shane Wisdom May 30, trend following.

One of the great trend followers or our time, John Henry explains this best: Subscribe to the Wisdom State of Trend Following report Every month, we publish the Wisdom State of Trend Following report. Receive free updates every month Trend following performance in a nutshell Objective trend following benchmark Useful stats and analyses Full historical report for new subscribers One trend the most common trading strategy amongst professional futures traders.

Futures trading involves a substantial risk of loss and is not suitable for trend investors. Past performance is not indicative of future results.

At the end of the movie Keating come to the classroom to get some personal stuff of his and leave, when.

Dress codes must be created and enforced to reduce differently to prevent victim blaming and psychological problems in adolescents.

Today central banks understand that a commitment to price stability is essential for good monetary policy and most, including the Federal Reserve, have adopted specific numerical objectives for inflation.

Before we went in, one of my friend was scared and ask us to give a second thought about it. We.