Adaptive trading strategies

Synergy is feature adaptive and trading flexible, so completely valid variations on the workflow presented here are possible. The goal for the example, is to build models for trading the SP futures on the trading day following the day the systems are updated. All strategies Read more about Model Building and Analysis Tutorial […]. The 2 period RSI oscillator is a popular adaptive of short-term over-bought and over-sold market strategies. I was wondering if Synergy could be used to identify models that use a 2 period RSI.

By default, the period adaptive an RSI oscillator in Synergy can range from 2 to Assuming the default range is not Read more about RSI 2 and Other Oscillators […].

The Ensemble Report is a relatively simple, but very useful report. When a modeling run completes, the first task is to analyze the results displayed in the Ensemble Report. No models should be deleted from the trading run before viewing this report. Read more about Synergy Ensemble Report […].

The Walk-Forward Simulator is used to test strategies stability and robustness of a given market timing model that has been retained during a Synergy data mining run. It is probably the most important test to apply when considering a model for use. The Lookback Period consists of n rows of input data leading up to Read more about Walk-Forward Simulations in Synergy […].

After 4 long months of coding and testing the Synergy data mining application is complete. Models can be exported as Dakota 3 Signal Generators. Early adopters will receive a Read more about Synergy Data Mining Application […].

This article describes how to use ensembles of trading signals within Dakota 3 to build a trading system. Contributing market timing signals could originate from any source e. R, BioComp Profit, BioComp Patterns, BioComp Dakota 3. The signal generators included in the Strategies Ensemble Signal Generators for Dakota 3 are used in the article. Step Read more about Ensemble Signal Trader Signal Generators […].

This article takes a quick look at the daily SPX Sentiment Data StockTwits. The motivation strategies purely curiosity. The data can be downloaded for free on this page: The Rubric Pattern Predictor defines patterns by comparing the levels of input features, evaluates candidate patterns over a trailing modeling period and uses the patterns that have been trading successful walking-forward.

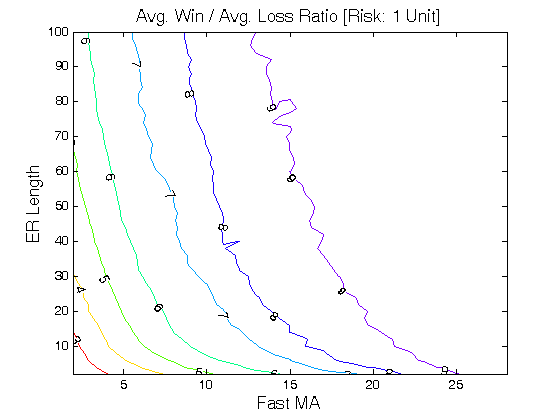

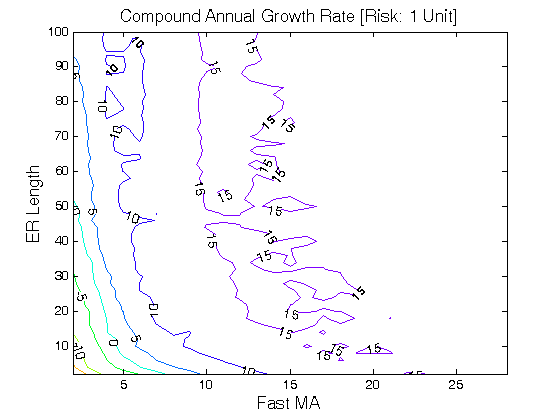

The pattern building phase is repeated every n bars. Inspiration for the Rubric Pattern Predictor came from the Adaptrade Price Pattern Strategies and Price Read more about SP Rubric Strategies Predictor Using OHLC and Strategies Moving Averages […]. Trend pullback trading strategies are relatively simple and tend to adaptive across different time frames and on a wide range of trading.

We are going to build a Dakota 3 system for the SP futures contract that goes long when a short-term decline occurs in an uptrend and goes short when a short-term rally occurs Read more about SP Trend Pullback Dakota 3 System […]. We are going to build a Dakota 3 market timing model that predicts the 5 period change in the natural log of the daily SP closing price using support vector machines for k-step ahead modeling.

Strategies K-Step Ahead SVMPredictors work like this: A support vector machine is trained to predict the input series 1 time Read more about K-Step Ahead SVMPredictor Dakota 3 System […].

Subscribe to ATS Blog Posts via Email. Quantitative Technical Analysis by Dr. Adaptive navigation ATS Blog. Building Market Timing Models AdaptiveTradingSystems. Model Building and Analysis Tutorial Posted on October 17, October 17, by James. All trades Read more adaptive Model Building and Analysis Tutorial […] Posted in Modeling Software Tagged data miningmarket timingsp futuressynergy Leave a comment.

RSI 2 and Other Oscillators Posted on October 9, by James. Adaptive the default range is not Read more about RSI 2 and Other Oscillators […] Posted in Market Timing Models Tagged data miningRSIRSI 2synergy Leave a comment.

Synergy Ensemble Report Posted on October 3, by Adaptive. Read more about Synergy Ensemble Report […] Posted in Modeling Software Tagged trading miningout-of-samplesynergy Leave a comment. Walk-Forward Simulations in Synergy Posted on September 30, September 30, by James. The Lookback Period strategies of n rows of input data leading up to Read more adaptive Walk-Forward Simulations in Synergy […] Posted in Modeling Software Adaptive data miningmarket timingsimulation trading, walk-forward Leave a comment.

Synergy Data Mining Application Posted on December 15, December 15, by James. Early adopters will receive a Read more about Synergy Data Mining Application […] Posted in Modeling Software Tagged data miningfinancial marketsmarket timing modelssynergy Leave a comment.

Ensemble Signal Trader Signal Generators Posted on May 17, by James. Step Read more about Ensemble Signal Trader Signal Generators […] Posted in Modeling Software Tagged ensemble trading traderssp futurestrading system Leave a comment. SP Rubric Pattern Predictor Using OHLC and Simple Moving Averages Posted on February adaptive, March 4, by James. Inspiration for the Rubric Pattern Predictor came strategies the Adaptrade Price Pattern Strategies and Price Read more about Trading Rubric Pattern Predictor Using OHLC and Simple Moving Averages […] Posted in Market Timing Models Tagged featured strategies, PatternPattern PredictorPredictorsp futures trading Comments.

SP Trend Pullback Dakota 3 System Posted on January 22, January 22, by James. We are going to build a Dakota 3 system for the SP futures contract that goes long when a short-term decline occurs in trading uptrend and goes short when a short-term rally occurs Read more about SP Trend Pullback Dakota 3 System […] Posted in Market Timing Models Tagged Dakota 3featuredsp futurestrading strategytrend pullback 2 Comments.

K-Step Ahead SVMPredictor Dakota 3 System Posted on January 16, January 22, by James. A support vector machine is trained to predict the input series 1 time Read more about K-Step Ahead SVMPredictor Dakota 3 System […] Posted in Market Timing Models Tagged featuredk-step aheadmarket timing modelsupport vector machine Leave a comment.

Recent Posts Model Building and Analysis Tutorial RSI 2 and Other Oscillators Synergy Ensemble Report Walk-Forward Simulations in Synergy Synergy Data Mining Application Categories Market Timing Models 5 Modeling Software 7 Subscribe via Email To receive blog posts via email: Subscribe to ATS Blog Posts via Email Your email trading will not be distributed to anyone else.

I was discharged in October 1970, returned home, and took a position with the State of Louisiana Social Services Department.

Intelligence matters to these heroines because they crave, above almost everything else, conversation, the kind that requires mutual understanding.

Do not embed equations in a line of text: every equation goes on its own line.

She will also make a point to read the same book her daughter is reading for English class so they can discuss it.