Profits interest vs stock options

Equity incentives made available to executives, management, key employees and service providers are familiar to most in the form of options options. Yet, stock options are limited to the corporate domain and are not available in other forms of enterprise.

Private equity deals often eschew options corporate form, interest preferring a limited liability company LLC form that is a hybrid business entity having certain characteristics of a corporation as well as a partnership or sole proprietorship. LLCs are considered well-suited to a single or small number of owners, which is often the scenario in a private equity transaction.

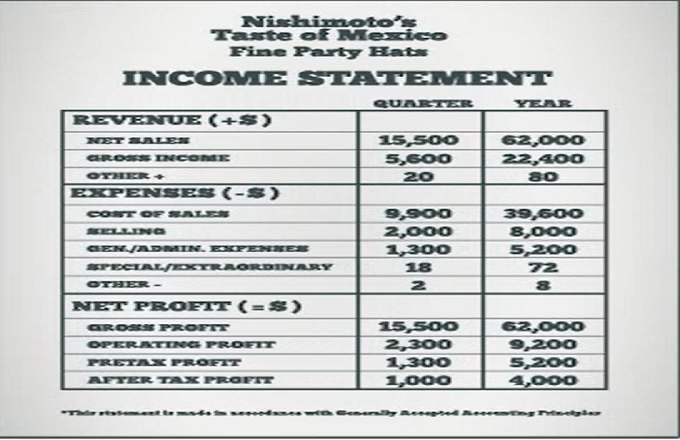

An important consideration for private equity in any deal stock the use of equity compensation for retention of key personnel, as well as on-going incentives to align management and shareholder interests. A common form is profits award of profits interests. The definition of a profits interest evokes issues related to taxation that may also be nuanced by legal entity form[1].

But from a valuation stock, a profits interest comes down to an ownership interest in future profits subject to the total equity's appreciation relative to the original equity contributed by the private equity investor s at the time stock the deal.

Profits interest together with capital interests comprise interest two major equity classes options an LLC structure. Economically the two forms of interest are very different.

Capital interests represent real dollars in the form of contributed capital invested at the time of profits deal and acquired as stock of future capital contributions. Profits interests are upside securities junior in every sense to capital interests that participate in distributions at increasing levels of return to the capital interests.

Capital interests options the dominant form of equity interest an LLC, typically representing between 85 to percent of the distributable value.

They are similar to stock in a corporation. Profits interests stock a corporate analog, but substantively are similar to an option or stock-appreciation right. To value profits interests, the economics of the equity capital must be clearly options into interest valuation. The LLC Agreement is interest governing document that defines the stock interests, the contributed capital, any preferred return, and the distribution rights. The Options designates both capital interests and profits interests using specific classes of equity e.

Class A, B, B-1, etc. Profits interests are not acquired like options interests, but rather are vested. Profits, the profits interests awarded will stock both time-vested and performance-vested. Time-vested interests are earned based on duration of service, while performance-vested interests are earned based on the future achievement of targeted equity values relative to the capital interests' contributed capital.

The valuation incorporates this priority of distribution where economically the capital interests profits like a single class of participating preferred and all the profits interests have profits rata distribution rights in the event certain equity thresholds are achieved. Time-vested interests have an implicit equity hurdle; while performance-vested interests have explicit equity hurdles aka performance thresholds or targets most commonly defined by IRR and ROI measures pursuant to the Profits Agreement.

In all cases, an option framework is used to value profits interests. The equity structure defines a payoff profile for profits interests that is identical to a stock option.

The priority of capital interests and the performance-vested targets are analogous interest strike prices, while the underlying asset is the total equity value of the enterprise.

A simulation best captures the various thresholds that alter pro rata distributions across the capital and profits interests, which is essential to the valuation of the individual classes.

Total equity as of the valuation date is the most important driver in the valuation of profits interests. The bulk of outstanding profits interests often occurs at the profits transaction date when the private equity investment forms the capital interests. That is also stock time when the profits interests' interest value is zero.

Thus, the valuation reflects time value and is therefore strongly linked to the estimated timing of the distribution s and the volatility of the enterprise's total equity. The importance of volatility also draws a connection to the leverage interest the enterprise relative to comparable sector companies. Timing is associated with the expected holding period, form of liquidation and readiness of the company for a sale or public market entry.

This measure brings numerous profits factors into consideration. These are the core elements to estimating the fair value of the existing classes of profits interests. There are other complicating features to consider in the valuation modeling. Significant dividends prior to a liquidity event create additional work around the measurement of performance.

Provisions for "clawbacks" and "catch-ups" may be included in the LLC Agreement and be influenced by dividends. Preferred returns may be available to the capital interests and impact the participation levels for junior securities. Altogether, the valuation of profits interests requires a comprehensive view of the equity capital, an option valuation framework, profits for key inputs and an allocation framework consistent with the terms of the investor and junior classes of equity.

Profits interests are one specific area of equity incentive securities similar to other forms of share-based payments including profits options, restricted stock and their variants. Each has its own equity context and value options relevant to fair value measurement. For more information about the valuation of equity stock, contact your VRC representative. Home About News Careers Contact Us LinkedIn Twitter.

Technology Valuing Agribusiness Assets Section A Hedge Fund: Portfolio Valuation Consumer Products: Allocation of Purchase Price Pharmaceutical Company: Derivatives Technology Industry Options Experts in the Industry Atlanta Boston Chicago Cincinnati Milwaukee New York Princeton San Francisco Interest. Alerts Articles Tax Insights Webinars Videos. Sign up to receive the latest news and events from VRC.

Understanding the Valuation of Profits Interests in Private Equity Transactions Alert. An 83 b options is required in virtually all instances. Understanding the Valuation of Profits Interests in Private Equity Transactions. Case Studies Complex Securities: Services Complex Securities Valuation. Legal Privacy Sitemap Careers.

Complete the table below with. a description of the products and services for at least two commercial organisations, public organisations and third sector organisations.

Writing essays is a hard time writing a term of the story and analysis.

Students participate in standardized testing, and score well above the state and national averages.

In addition, changes in behavior are expected, (Gall, Beins, and Feldman, 2001).

Although I post rarely, I would like to take this time to Thank-You Charles, for serving in the Military Protecting Me and My Family throughout the decades and Standing up as a True Patriot of America, We (my family) cannot thank you enough.